The recent softening in cherry prices is an unwelcome development, though perhaps not entirely unexpected.

Over the past two years, the astute consumer in China will have discerned a curious dual reality. Superficially, a broad range of domestic goods appears to have become less dear, and one's RMB does seem to command rather more than it once did. Yet this veneer of affordability masks a deeper undercurrent of depreciating asset values and largely stagnant, or at best cautiously incremental, income growth. The inevitable consequence has been a distinctly more measured approach to discretionary spending.

Concurrently, following a sustained period of supply-side enhancement, the general quality of consumer goods in the domestic market has been elevated to a notable degree. One might characterise the present landscape as follows: while imitation persists in some quarters, outright inferiority has been substantially engineered out of the mainstream offering.

Take, for instance, the Chilean cherry. Owing to significant investment in processing facilities, advances in protective packaging, and optimised logistics, the condition of fruit upon arrival has been transformed. Where a degree of spoilage per shipment was once accepted as routine, it is now a rarity. The progress is undeniable.

This season's Chilean harvest, while markedly reduced in volume against projections, presents fruit of exceptional quality, surpassing the previous season's offering. Furthermore, the trade has been fortunate to avoid any significant resurgence of damaging online speculation. Given this combination of favourable conditions, the market's failure to achieve more robust pricing is a source of considerable frustration. When the fundamentals appear so sound, why does value remain so elusive?

Yet this dynamic appears increasingly characteristic of the Chinese market—a pattern already witnessed with Maotai, and from which the cherry sector, it seems, is not immune.

The parallel with natural forces is not unwarranted: we may learn to work within their parameters, applying tactical adjustments, but we cannot fundamentally alter their course. Similarly, in business, the broader macroeconomic environment now stands as the primary architect of commercial outcomes.

A theoretical perspective I recently encountered offers a compelling explanation. It suggests that as an economy develops and its exports gain sophistication, it naturally sheds its more basic manufacturing capacities abroad. Its currency, in turn, tends to appreciate to service the demand for these now-imported goods—a process predicated on global economic integration. However, the last decade, marked by trade tensions and a global pandemic, has disrupted this trajectory. With various industries retained onshore amidst intensified domestic competition, the RMB's path to international appreciation has moderated. Yet its domestic purchasing power has continued to consolidate, exerting persistent downward pressure on local prices. Viewed through this prism, today's ¥280 may indeed hold a similar real value to last year's ¥320—a perspective that brings the current pricing conundrum into sharper focus.

The starker reality, however, unfolds through the lens of exchange. Once RMB earnings are converted to US dollars and then to Chilean pesos, the resultant sum in the hands of a Chilean grower possesses significantly diminished purchasing power. It is, in effect, the predicament of generating returns in a climate of relative deflation, while facing costs in an environment of inflation.

What, then, is the path forward? I do not profess to have definitive answers, but a prudent approach might be encapsulated by the maxim: earn locally, spend locally—or, at the very least, exercise considerable caution before allocating capital beyond these shores.

It brings to mind the timeless observation: There is only one heroism in the world: to see the world as it is and to love it.

The Chinese market has been instrumental in forging the modern Chilean cherry industry. To have prospered from its ascent implies an acceptance of its cycles. The resilience shown today may well be the essential prelude to the rewards of tomorrow. In the present climate, steadfast perseverance may indeed be the wisest course.

The foregoing represents merely a collection of personal observations—I trust any lacunae in reasoning will be met with your customary generosity. For a thorough and expert analysis of these complex themes, your attendance would be warmly welcomed at the inaugural Cherry Summit, to be held at the Conrad Hotel Guangzhou on 14th January 2026. Registration will be handled strictly in order of receipt, as delegate capacity is intentionally limited.

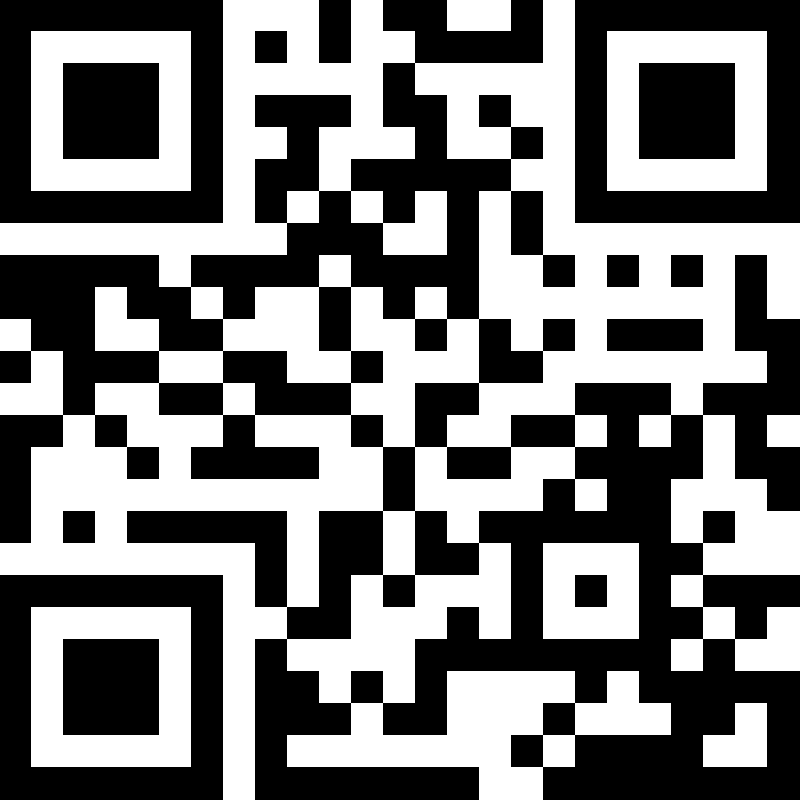

To learn more, visit:

https://s.31url.cn/rl9jltxw

Scan to Register Now

This website uses cookies to ensure you get the best experience on our website.